The following article is taken from Al DiLascia’s article, Education Savings Accounts, published by Journal Inquirer.

There are 31,345 Catholic students in the state [of Connecticut], a number that is rapidly declining. The average cost of a public school student is $16,592. Catholic schools currently save taxpayers more than $520 million. If all these schools were to close — and this is not farfetched — this burden of $520 million would fall directly on the backs of taxpayers. That would continue each and every year thereafter, with certain expected increases.

In addition, there would either need to be expansion of present schools or new schools built to accommodate the 31,345 students. This would be an estimated one-time cost of $2.5 billion, with ongoing annual costs of maintenance and upkeep of this school expansion — again, a massive cost placed on the backs of taxpayers.

Think about it, every time a Catholic school student leaves the private school, taxpayers will be paying an additional $16,592, plus periodic increases.

Several enlightened states who realize the financial importance of Catholic and private schools have been creative in helping these schools, while at the same time making it a win/win for the state and for education. They have passed legislation concerning such things as tax credits for schools and offered other creative financial help ideas. Education savings accounts might well be the answer for Connecticut.

To read the full article, click here.

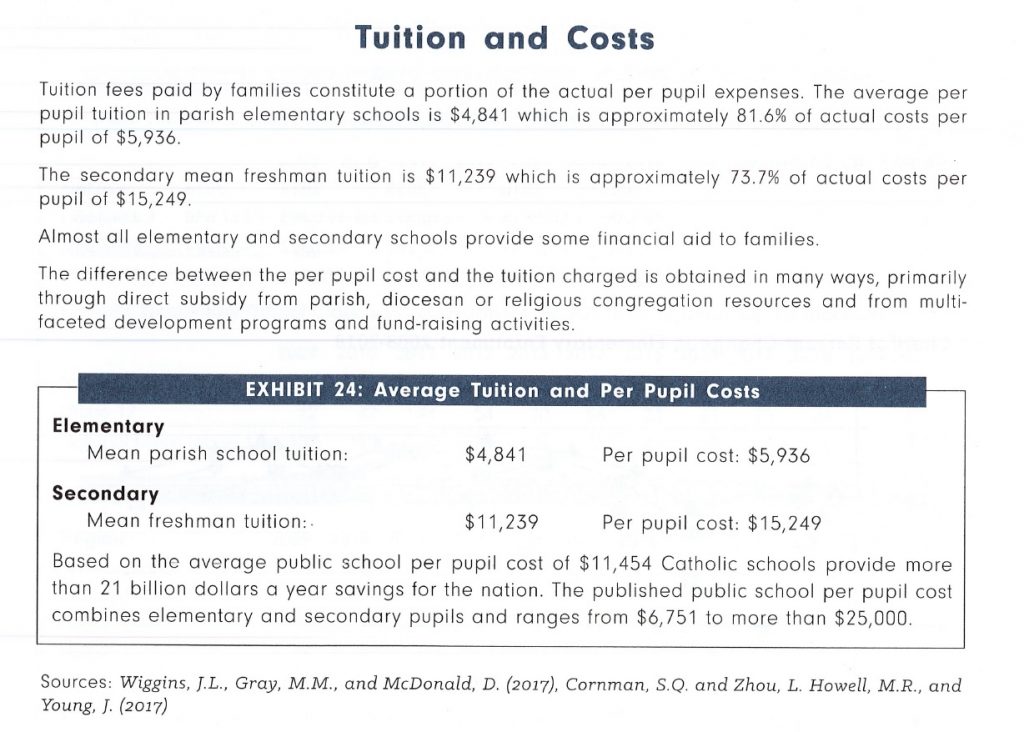

In reference to national figures, “Catholic schools provide more than of 21 billion dollars a year savings for the nation” (United States Catholic Elementary and Secondary Schools 2017-2018: The Annual Statistical Report on Schools, Enrollment and Staffing).